Social Security Benefits for Veterans: Planning for Retirement

Jan 31, 2025 | 6 min. read

What changes are coming to Social Security in 2025?

When it comes to timing your retirement and receiving your Social Security benefits, there is no “one-size-fits-all” solution. These decisions depend on numerous factors related to your circumstances and objectives. The Social Security Administration is a good place to start. With an online account, you can view earnings statements, receive personalized estimates of future benefits based on actual earnings, and use various calculators to help compare different scenarios.

Changes Coming to Social Security in 2025

2025 Social Security COLA Increase

In 2025, Social Security is set to undergo significant updates, making it essential to stay informed as you plan ahead. The Cost of Living Adjustment (COLA) will be 2.5%, to keep benefits on pace with inflation. For military retirees, this adjustment mirrors changes in military pensions—learn more about specific impacts here.

2025 Maximum Taxable Earnings

The maximum taxable earnings, known as the contribution and benefit base, will rise to $176,100. Income up to this amount will be subject to the 6.2% Social Security tax, paid by both employees and employers.

With these updates in mind, it’s time to evaluate your retirement strategy and how these changes could influence your financial future.

When am I Eligible for Full Social Security Benefits?

The first requirement to become eligible for Social Security benefits is to earn 40 credits, which means recording 40 quarters of earnings during which you paid Social Security taxes. The next requirement is reaching the age of eligibility. To slow the depletion of the Social Security Trust Fund, the 1983 Social Security Amendments raised the full retirement age (FRA), the age at which you are eligible to receive full Social Security benefits. For those born in 1960 or later, the FRA is 67, though you do not have to begin receiving Social Security at your full retirement age.

At What Age Should I Begin Receiving My Social Security Benefits?

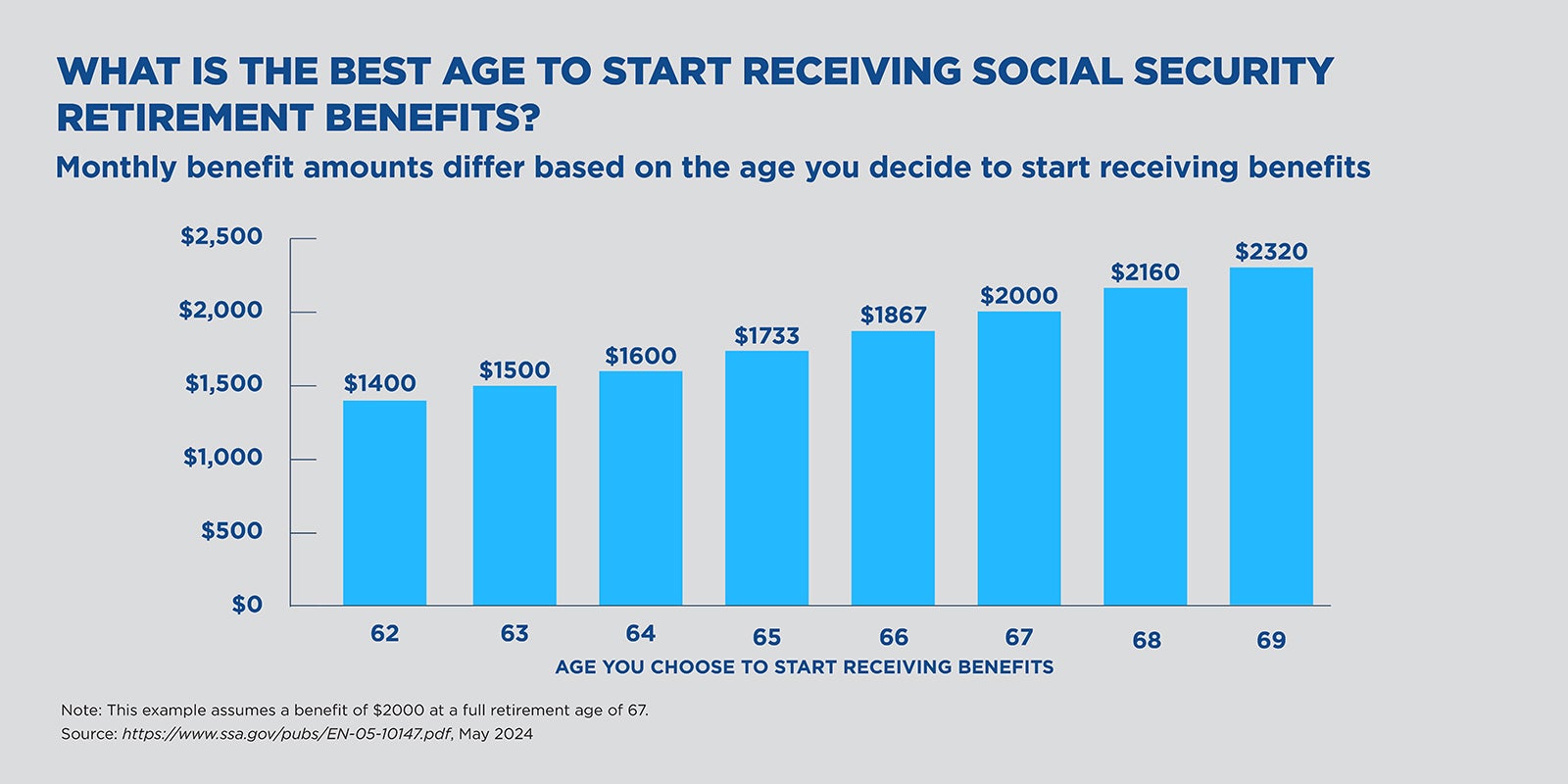

You can begin receiving benefits as early as 62, or as late as 70. However, if you elect to receive them at 62, they will be approximately 30 percent lower every month than if you waited until your full retirement age.

Conversely, if you defer receiving your benefits beyond your FRA, they will increase by 8 percent each year until you reach 70. To better compare these scenarios as you plan when to receive Social Security, check out the table below.

When is the right time to start receiving Social Security benefits?

The answer depends on factors like your planned retirement age, whether you can retire without Social Security income, and how your health may impact your life expectancy. A knowledgeable financial advisor can help you evaluate your options and make a decision aligned with your goals and circumstances.

When considering taking Social Security benefits, ask yourself these questions:

- Do you intend to keep working? If you haven’t reached full retirement age, this could limit the benefits you receive now.

- Do your family members typically live until an old age? If so, you may want to hold off on taking benefits.

- How is your health? If it’s poor, you may want to opt for an earlier start date than someone in good health.

- Do you have health insurance? Remember that Medicare doesn’t start until age 65.

- Do you qualify to receive benefits as a widow, widower or surviving divorced spouse? You may have other options to consider.

- Can you afford to wait beyond your full retirement age to receive benefits? If so, you may be eligible for delayed retirement credits, which could mean a higher benefit.

- Do you have family members that qualify for benefits on your record? Your decisions may affect them.

Do Military Retirees Get Social Security?

Military retirees can get both Social Security benefits and military retirement benefits. Generally, there is no reduction of Social Security benefits because of your military retirement benefits. You’ll receive Social Security benefits based on your earnings and the age you choose to start receiving benefits.

In addition to retirement benefits, the Social Security Administration pays benefits to the surviving family members of military service members who die. Service members can also receive benefits for themselves and their families if they develop a disability.

Special Extra Earnings for Military Service

Under certain circumstances, special extra earnings for periods of active duty or active duty training from 1957 through 2001 can also be credited to your Social Security earnings record. These extra earnings may help you become eligible for Social Security or increase the amount of your Social Security benefit.

How Much Money Will You Need in Retirement?

Deciding when to begin your Social Security benefits is part of a larger decision about when to retire. Making that decision may depend on your retirement living expenses.

For many years, the conventional wisdom was that people would need about 70 to 80 percent of their pre-retirement income in retirement. That may no longer be the standard as many people are living longer. While it’s true that some of the expenses associated with working don’t carry over into retirement, they may be more than offset by the expenses associated with retired lifestyle activities. For these reasons, it seems prudent to plan on needing closer to 100 percent of your pre-retirement income.

How Will My Social Security Benefits be Impacted if I Choose to Keep Working?

Another emerging trend is the sizeable portion of seniors who don’t want to quit working or choose to work part-time to stay engaged or give back to their community. This is a viable option, but you’ll need to plan for a temporary reduction in benefits of $1 for every $2 you earn over the stated earnings limit, which is $23,400 for 20251 This reduction only applies before you reach full retirement age, at which point the benefit is recalculated to adjust for the time when your benefits were reduced.

Build a Comprehensive Retirement Income Plan

It’s important to remember that your estimated Social Security benefits are just that—an estimate—based on many factors, including potential earnings changes and adjustments due to cost of living increases. In addition, they are based on current law, which is subject to change.

Reserves that help fund the program are projected to be exhausted by 2035, which has alarmed many for years. Even if this occurs, however, it’s estimated that the transfer of wealth from those in the workforce will still provide retirees with 79 to 83 percent of estimated benefits.2

Social Security is one important component to financing your retirement, but most people will need several sources of income to meet all their needs. To estimate how much you’ll need for retirement and to create a plan for it, contact a knowledgeable First Command Financial Advisor.

1https://www.ssa.gov/cola/

2https://www.ssa.gov/OACT/TRSUM/index.html

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.